Interest on Education Loan in India; Government Schemes & Private Banks

With the increasing demand for skills to accommodate oneself in this growing world of technology and digitization, Quality Education is at risk. Quality education has become mandatory for a complete and successful life.

For many, it is equivalent to graduating from the best institution& acquiring precise knowledge of the field. The cost of education is, however, increasing rapidly. In verity, the cost of studying at presumed institutions is already pretty high.

To deliver students with affordable loans in order to receive a good education and complete their graduation and post-graduation in various disciplines of study, many banks provide Educational loans.

The following article highlights the eligibility& the procedure of the interest on education loan.

Education Loan Scheme By Government Of India – Vidya Laxmi Scheme By Narendra Modi

The government of India had started many initiatives one among them was launched on 15th August 2015 which is a portal “http://www.vidyalakshmi.co.in”.

The gateway has been developed and maintained by NSDL e-Governance Infrastructure Limited (NSDL e-Gov) under the direction of the Department of Financial Services in the fund service, division of advanced education, Ministry of HRD, and Indian Banks’ Association.

Prime Minister Mr. Narendra Modi has explained; how skill India requires to be thoroughly synchronized With Make In India. Yet, today less than 5% of our prospective workforce gets proper skill training to be employable and stay employable. The following article highlights the eligibility& the procedure of the interest on education loan.

Following the 3 easy steps will make you accessible to all the possible banks where you can apply for the loan.

- Register at the website https://www.vidyalakshmi.co.in/

- After registration > and email verification > log in.

- After login into the account fill the form > Common Education Loan Application Form

- Then you can apply for several banks and check your status for approval.

Eligibility for Education Loan

- The applicant applying for the loan must be a citizen of India.

- He/she should have established admission in recognized educational institutes in India or abroad.

- Must have secured at least 50% marks through HSC & Graduation

- The age of the applicant must fall within the set of 18 to 35 years during loan appliance.

- He/she should be undergoing a graduate/postgraduate degree or a PG diploma.

- The candidate ought to have secured admission in a college or university associated with UGC/AICTE/Govt. etc.

- Students pursuing full-time courses require to have a co-applicant who can be either parent/guardian or spouse/parent-in-law (in case of marital candidates).

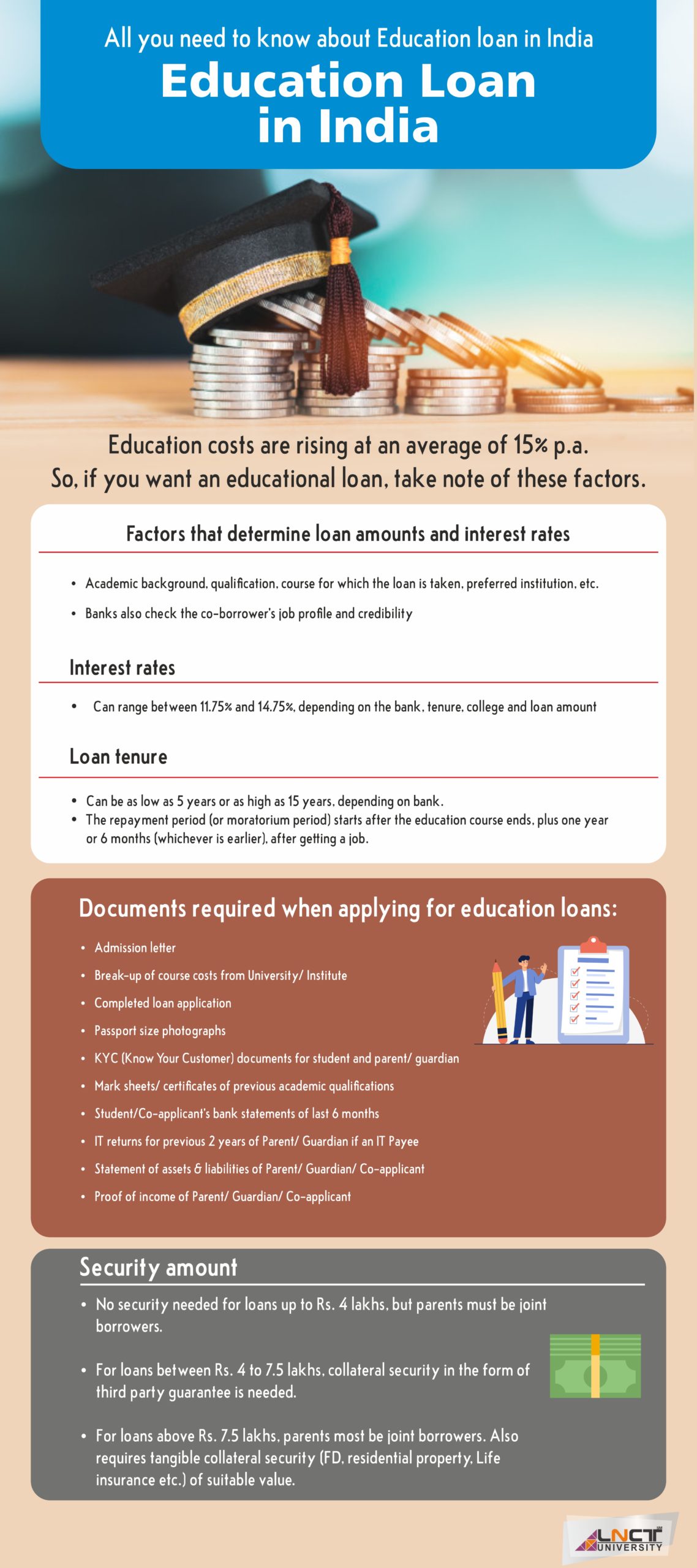

Documents for Education Loan for salaried individuals and Others

- The Candidates KYC documents are the basic requirement for the loan.

- Applicant’s Pass Book of last 6 months / Bank Statement

- Guarantor Form this is optional and specific to case

- admission letter copy of the Institute along with fees structure

- S.C., H.S.C, Degree courses passing certificates & mark sheets are required.

Once the loan request is acknowledged, the banks dispense the amount directly to the college/university as per the specified fees composition. The following article highlights the eligibility& the procedure of the interest on education loan.

Interest on Education Loan

The banks use the Marginal Cost of Funds based Lending Rate (MCLR), plus an additional increase to set an interest rate. The following article highlights the eligibility& the procedure of the interest on education loan. This is dynamic and subject to schemes and other details. These are best to be enquired about while applying for a student loan.

Loan financing & Collateral requirement

Bank asks for collateral on loans or third-party guarantees above 7.5 lakhs. The banks can finance up to 100% of the loan depending on the amount.

At present, for loans up to Rs 4 lakh, there is no margin money necessary on the whole margin money is the amount the applicant has to arrange from his own end. For education in India, 5% of the obligatory money has to be financed by the applicant. On the other hand, for studies overseas, the requisite margin money increases to 15%. The following article highlights the eligibility& the procedure of the interest on education loan.

Though these policies are comprehensive; there might be specific policies subject to banks.

Dispersal Of Education Loan &Repayment

The loan approval process has been made extremely user-friendly for better and efficient working. When the documents are thoroughly checked and verified, the installments start and the bank starts dispensing fees accordingly to the fee structure followed by the Institution. The repayment process is also very simple with pocket-friendly EMIs. The following article highlights the eligibility& the procedure of the interest on education loan.

Availing a student loan greatly helps and assists in receiving a quality education, without any external expenses, keeping in mind the low-cost EMI installments and a good amount of time for the repayment. The following article highlights the eligibility& the procedure of the interest on education loan.

The loan is repaid by the student. Usually, the repayment starts when the course is completed. Some banks even provide a repose period of 6 months after securing a job or a year after the end of studies for repayment. The following article highlights the eligibility& the procedure of the interest on education loan. The repayment period is normally between 5 and 7 years but can be extended further than that as well.

During the course epoch, the bank charges an easy interest rate on the loan. The payment of simple interest during the course period lessens the equated monthly installment (EMI) burden on the student for future repayments. The following article highlights the eligibility& the procedure of the interest on education loan.

Tax Déduction On Education Loan

Underneath segment 80E of the Income Tax Act, you can claim tax deductions only on the interest remunerated on your education loan during a financial year. You won’t get a tax advantage on the settlement of the principal amount. The following article highlights the eligibility& the procedure of the interest on education loan.

For instance, if the whole EMI of your education loan is Rs. 12,000, and Rs. 8,000 is the principal component and Rs. 4,000 is the interesting part, you can only claim Rs. 4,000 per month. So, for the total EMI paid on the loan, you can claim Rs. 48,000 for the financial year as tax deductions. The following article highlights the eligibility& the procedure of the interest on education loan.

There is no highest limit for the claim; tax deductions on interest paid for education loans. Nevertheless, you can only claim education loan tax savings or tax deductions for a maximum of 8 years. The following article highlights the eligibility& the procedure of the interest on education loan.

Read More: